Limited Company

From £122.50

You can buy TaxCalc Limited Company for just £122.50 + VAT

Make light work of your tax return

With a heritage dating back nearly 30 years, TaxCalc has been trusted by hundreds of thousands of taxpayers to help them with their tax return. Whether you know your way around the returns or need a helping hand, TaxCalc provides you with both HMRC Forms and SimpleStep® questionnaire methods of entry.

And when it comes to calculating the figures that go into the boxes, TaxCalc's numerous wizards and worksheets will help you make the correct choices and pay the right amount of tax.

Experts you can trust

TaxCalc Limited Company is based upon the same core technology as our award winning software for Practices, which are used by thousands of firms of accountants up and down the country.

TaxCalc's support team is staffed by tax professionals who are on hand to help you fill out your forms. We are so confident in our software that there is no additional charge for support. Our lines are open from 9:30am to 5:00pm Monday to Friday.

Individual and Corporation Tax returns included

TaxCalc Limited Company provides the limited company, its directors and their family members the correct returns for their affairs, complete with all necessary supplementary pages.

To submit your Corporation Tax Return you'll need attach a copy of your accounts*.

Ready for 2023-24 and FY24

Fully updated to include new allowances, rates and rules for the submission of 2023-24 tax returns.

Previous years available

If you need to complete a tax return for

an earlier tax year, we stock products to

buy and download that are suitable for

tax years dating back as far as 2020.

Accounts and Computations - Corporation Tax Returns

A Corporation Tax return consists of the CT600 form, a computation and a set of accounts. The computation and accounts need to be submitted online in the iXBRL file format.

TaxCalc Limited Company produces both the CT600 form and the computation.

*A set of accounts in the iXBRL file format can be produced by a variety of products and services. Once the accounts have been formatted into iXBRL format, you can easily attach them to your Corporation Tax return.

Returns by paper

If you wish to file your return by paper,

make sure your return reaches

HMRC by 31st October or face a £100

penalty per return.

Paying tax through your

PAYE code

If you owe up to £3,000 of tax to HMRC to avoid having to pay any tax you owe in one lump sum. Your tax code will be adjusted and any money you owe will be deducted from your salary each month over the following 12 months

Ultimate deadline for

online filing

If you need to complete a tax return and miss the paper filing deadline, you must file your partnership and individual tax returns by 31 January to avoid penalties.

Fully comprehensive, yet easy to use software

TaxCalc Limited Company is the simplest and most complete way to file your tax return online.Individual and Limited Company returns included

TaxCalc Limited Company provides the limited company, its directors and their family members with the correct returns for their affairs, complete with all necessary supplementary pages.

Easy to complete

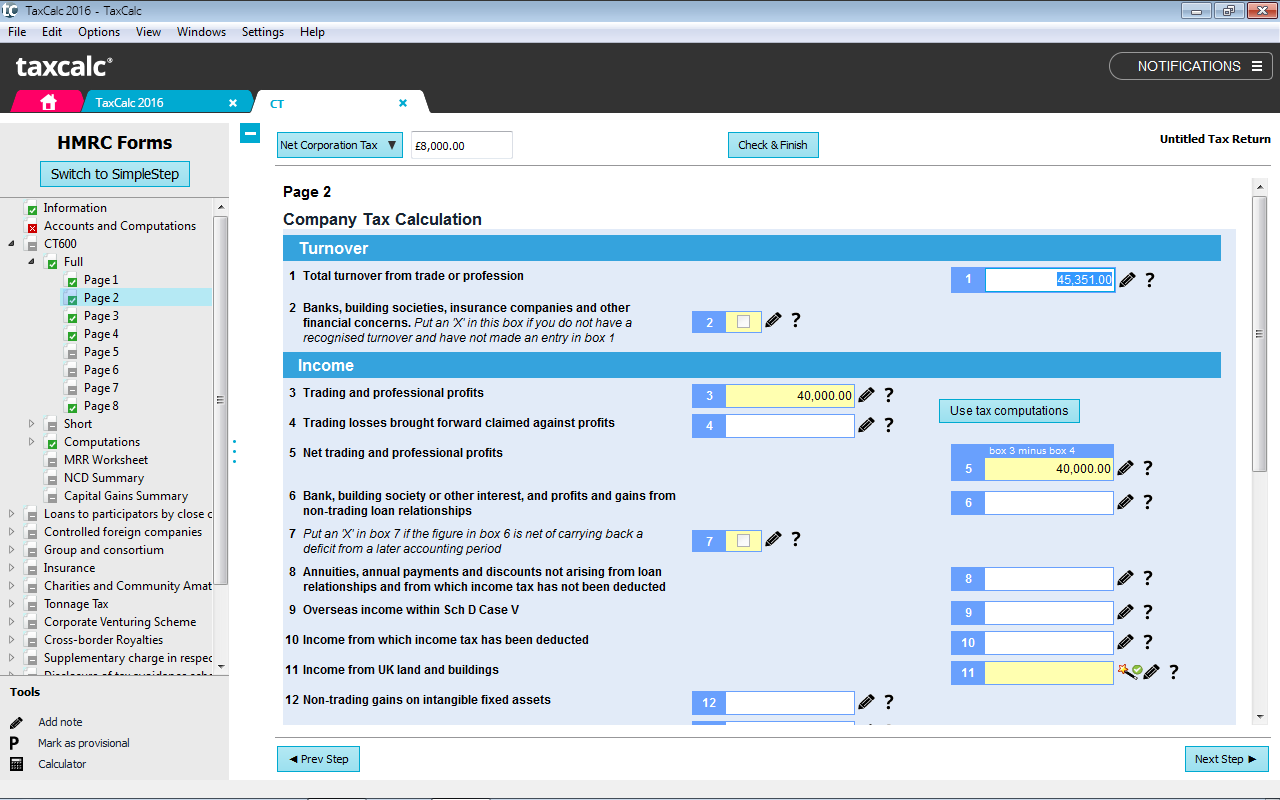

Fill out your return directly in HMRC Forms mode or let TaxCalc help you with our unique SimpleStep questionnaire.

You can then attach accounts in the necessary iXBRL format from any source.

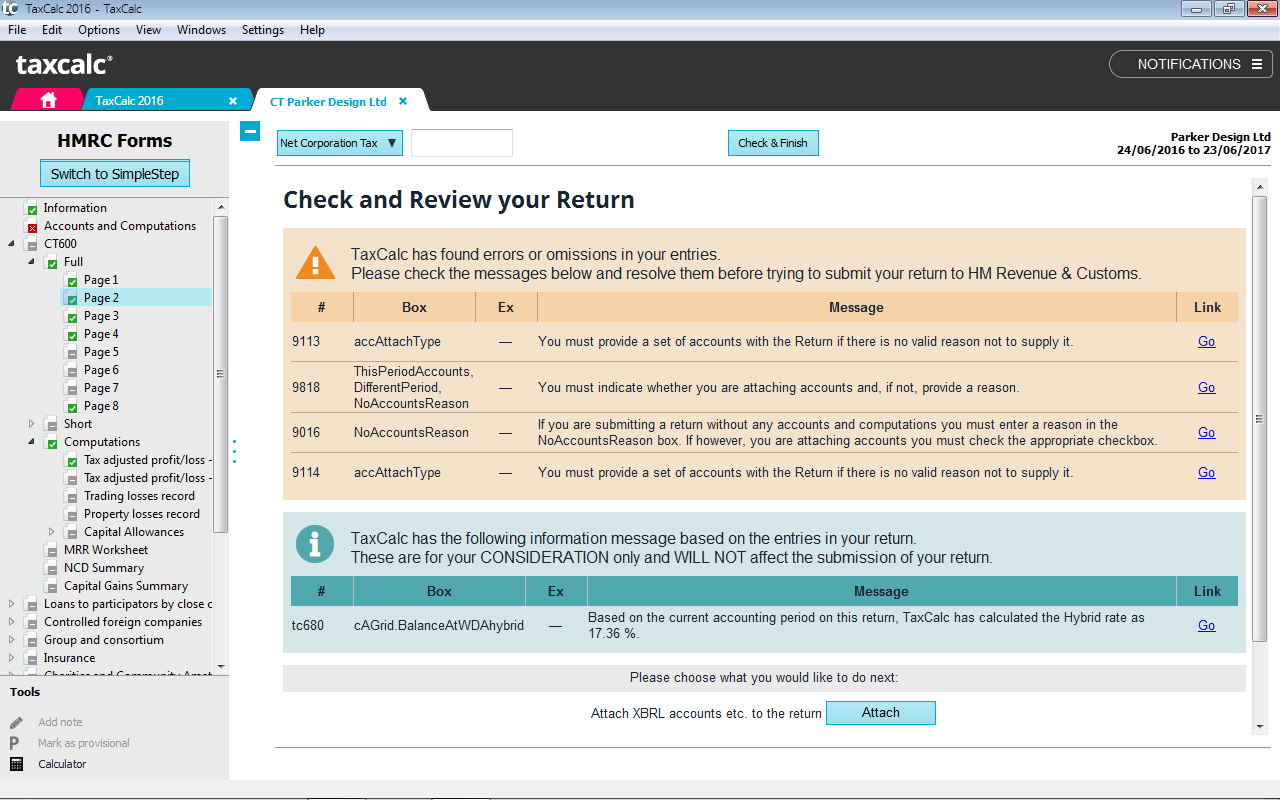

Check before you file

Peace of mind is everything when submitting your tax return.

Use Check & Finish to validate your entries and address any potential problems before you file with HMRC.

Ready for 2023-24 and FY24

TaxCalc Limited Company has been fully updated to cater for the 2023-24 tax year for Self Assessment and for FY24 for Corporation Tax.

Other useful forms

TaxCalc Limited Company includes some other handy forms such as the R40 Repayment form and the SA303 Reduction of Payments on Account.

Expandable and upgradeable

TaxCalc Limited Company can be upgraded with additional Individual, Partnership, Corporation Tax and Trust forms.

Please call 0345 5190 882 to discuss your requirements.

Features in detail

TaxCalc Limited Company provides you with all the featuresand functions to make light work of your tax return.

At a glance

- Fully updated for FY24, including version 3 of the CT600.

- Facsimile HMRC Forms mode for direct entry of your tax return

- Check & Finish routine to validate entries in your tax return

- All SA100 supplementary pages including Non-Residence, Lloyd's, Trusts and Ministers of Religion

- All CT600 Corporation Tax supplementary pages including the new Research and Development CT600L

- Import data from earlier years

- Detailed calculations and repayment summaries

- Produce Corporation Tax computations in iXBRL format with absolutely no manual tagging

- Produce comprehensive Corporation Tax computations with cover and contents pages

- Property company computations

- Compare last year's tax data with the current return

- Export reports to PDF, Microsoft Word and Microsoft Excel

- On-the-fly tax liability calculation

- Password protection your returns

- Automatic selection of long or short versions of forms

- Share data between spouses

- Auto-save function

- Context-sensitive help

- Full HMRC Forms and tax guidance help manual

- Unlimited email and telephone support

- Anonymous "send return to TaxCalc" function to get help from our Support team

Wizards to help you with:

SA100 Individual Return:

- Company car, fuel benefit and mileage claims

- Employment expense deductions

- Capital allowances

- Basis periods

- Class 2 national insurance

- Capital gains calculations (with preparation of calculations schedules)

- Foreign tax credit relief calculations

- Lump sum receipts

- Property wear and tear allowances

- Interest and dividend analysis worksheets

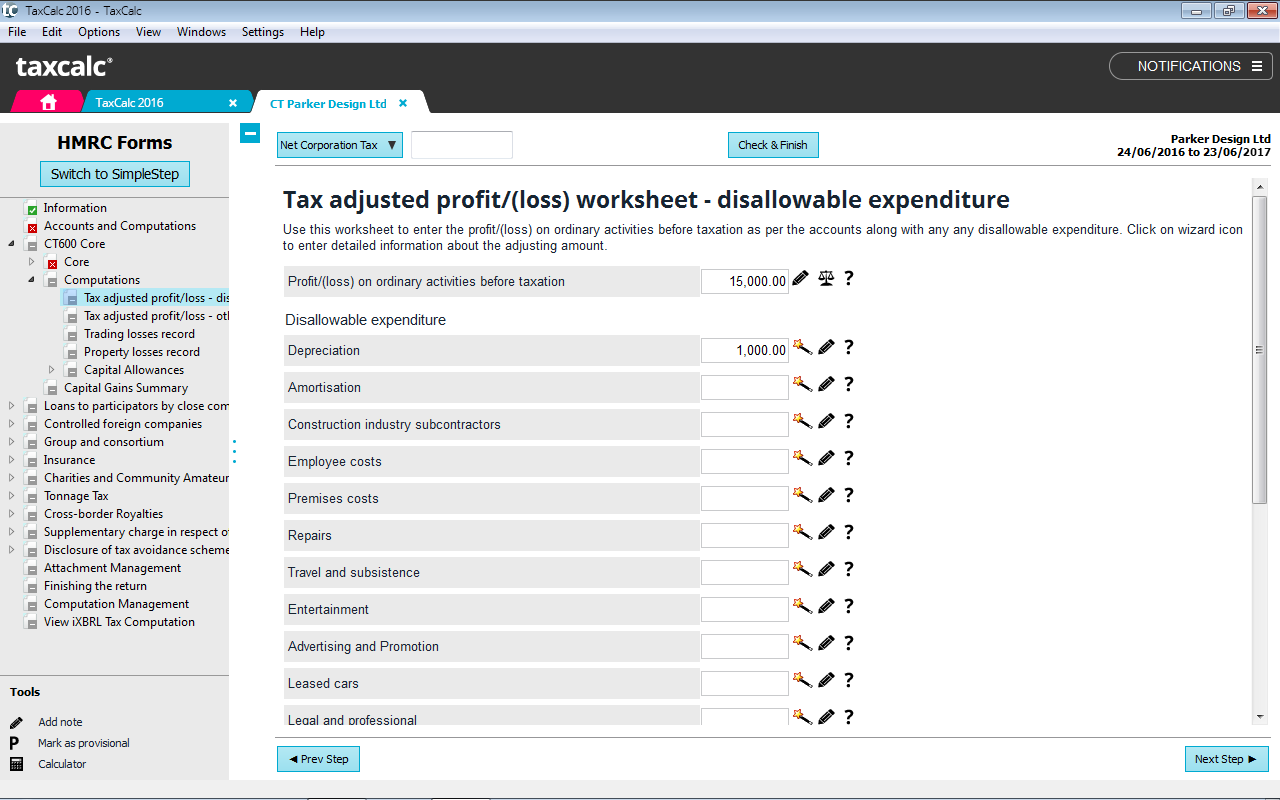

Corporation Tax Return:

- Trading profit and loss adjustments worksheet for Corporation Tax computation

- Chargeable gains calculations (with preparation of calculations schedules)

- Management Expenses record

- Research and Development relief

- Patentbox relief wizard

- Capital allowances

- Loans to Participators

- Corporation Tax loss handling record

Accessorise your TaxCalc

TaxCalc sports a number of helpful add-ons. You can choose one or more

add-on modules when you come to buy your software.

SA900 Trust tax return

If you have one or more Trusts and need to file SA900 Trust tax returns, this add-on provides you with the form for easy on-screen completion and online filing.

Income received from Trusts can be imported directly into SA100 Individual tax returns.

£40.00 + VAT

TaxCalc Dividend Database (2023-24 year)

Make the entry of dividend data a snap with this database of FTSE 350 and AIM 100 listed dividend data for the 2023-24 tax year.

Bring forward your shareholdings from your 2022-23 tax return and TaxCalc Dividend Database will do the rest.

The database is released in June each year to include dividends paid up to the end of the previous tax year.

£6.00 + VAT

TaxCalc What If? Planner

Use your 2023-24 tax return data to project your tax liability for the 2024-25 tax year. You can also create scenarios, adjusting your levels of income or to see the effects of decisions being made now on next years tax bill.

Applies to SA100 tax returns only.

The add-on is released in June each year to include changes announced for the next tax year.

£12.00 + VAT

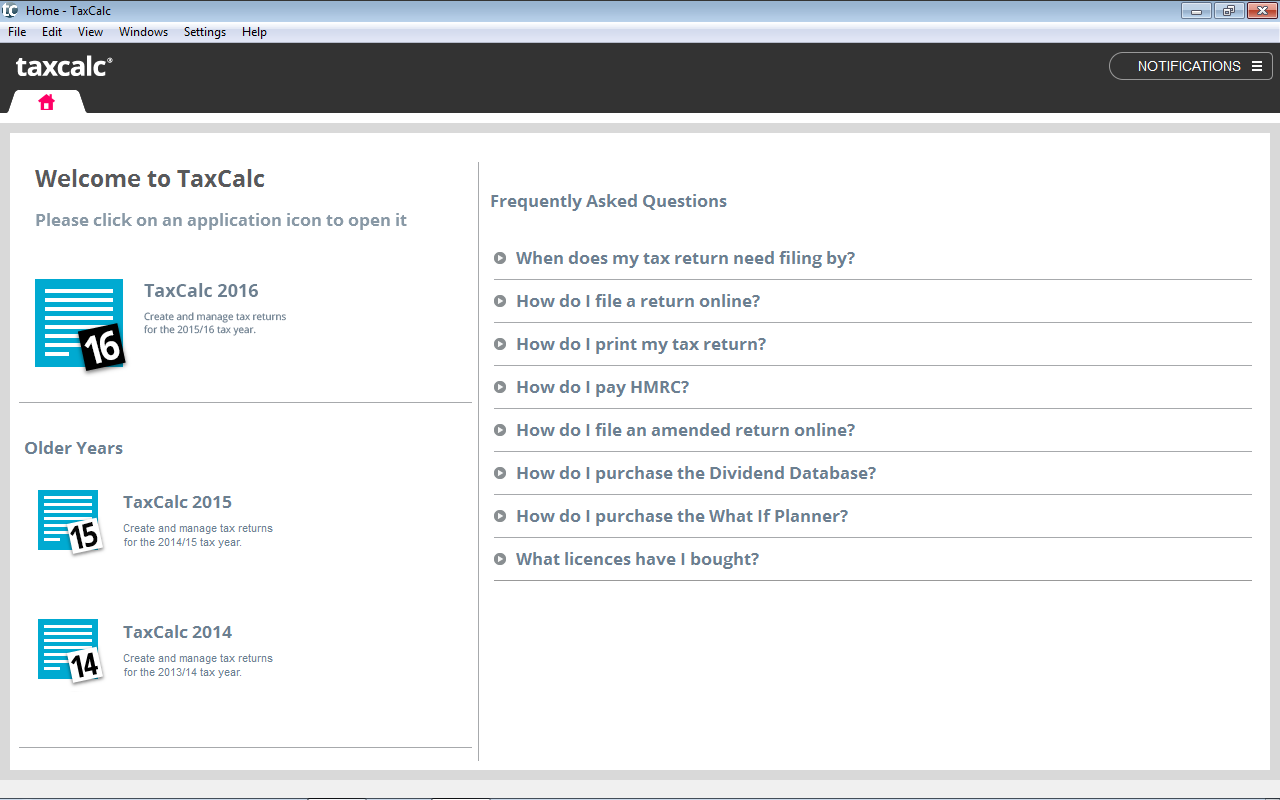

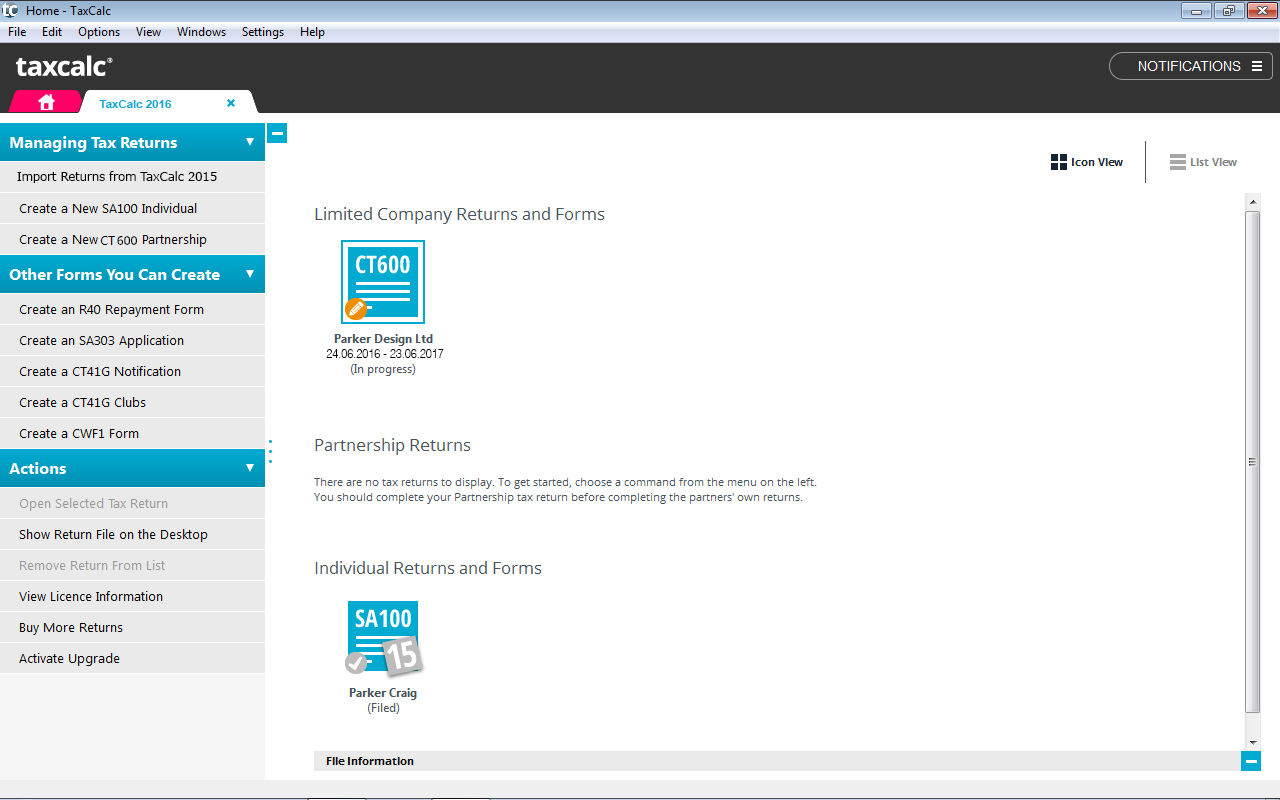

TaxCalc in action

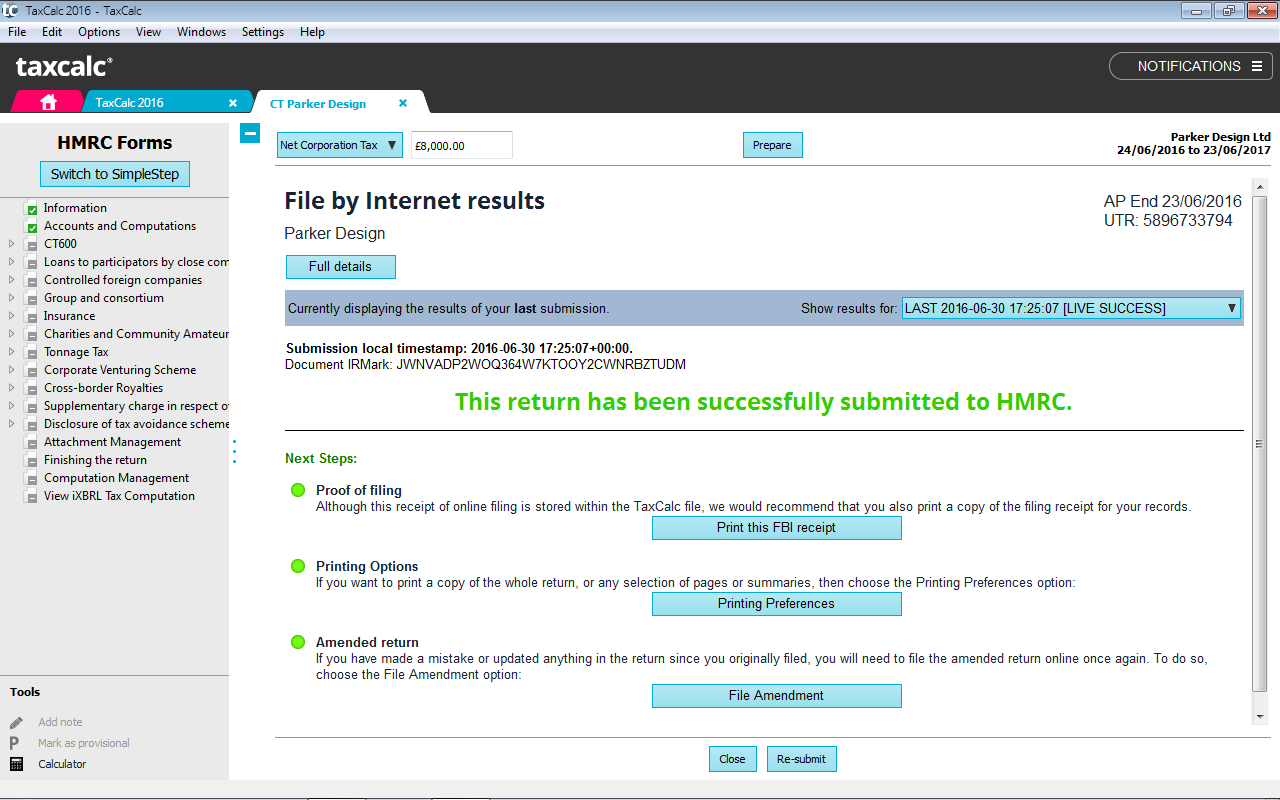

We pride ourselves on delivering high quality and easy to use software. Please click on a screenshot below tosee how you use TaxCalc and see how easy it is to complete your tax return.

TaxCalc organises and provides access to tax returns for the 2023-24 back to 2020-21 tax years*.

TaxCalc manages the production and progress of your tax returns, together with additional supporting forms.

TaxCalc contains two modes of entry. SimpleStep is our unique questionnaire mode, which guides you through the return, asking questions based upon answers given and data entered.

HMRC Forms mode displays a facsimile form for fast direct entry.

When you get to the end of your return, Check and Finish validates the entries you've made and highlights any potential issues before you file.

TaxCalc files online and tells you when your return has been successfully received by HMRC.

*TaxCalc is sold according to tax years, each of which is bought separately. Please see our Versions and Prices for more info.

Frequently asked questions

The questions below provide immediate answers to many aspects of TaxCalc Limited Company.If you have any further questions, please call 0345 5190 882 or email sales@taxcalc.com

Do I also need to prepare accounts?

Yes, accounts need to be prepared in the appropriate iXBRL format but TaxCalc allows you to attach accounts produced either with an external package or with TaxCalc Accounts Production.

Does TaxCalc work on

Windows 10?

Yes. TaxCalc's software has been fully tested with Microsoft's latest operating system and we can confirm that it does indeed work with Microsoft Windows 10. For a full compatibility list please see the System Requirements for TaxCalc.

Does TaxCalc work on Apple

Macs?

Yes. TaxCalc will run on any 64-bit Macintosh running Mac OS 10.12 or higher.

Does TaxCalc work on Linux

Yes. TaxCalc will run on any 64 bit kernel 3.10 (or higher), Debian (e.g. Ubuntu) or Redhat based distributions.

Do I have to buy the software

every year?

TaxCalc is an annual purchase because we have to redevelop it each year to new rates and tax rules. Your licence is perpetual and will continue to provide future access to unused returns for purchased tax years.

Since TaxCalc is an all-in-one application, when you buy next year's licence, all you need to do is open TaxCalc and it will update itself to add in the 2022-23 forms.

Can I upgrade or add

additional returns?

Yes. TaxCalc Limited Company can be upgraded with additional Individual, Partnership, Corporation Tax and Trust forms.

To discuss your requirements, please call us on 0345 5190 883 or email sales@taxcalc.com.

Can I buy previous years'

returns?

Yes. We supply tax software dating back to the 2014-15 tax year. You can find this on the Versions and Prices page.

How many computers can

I install TaxCalc Limited Company onto?

For your convenience, TaxCalc Limited Company may be installed on up to two computers.